Top 3 Reasons To Buy a Home Before Spring

Buying a few weeks before spring isn’t about rushing. It’s about choosing to be ahead of the curve and knowing you want more leverage, less stress, and meaningful savings.

If you’re ready and able to buy now and want to get the ball rolling, let’s connect.

It’s Getting More Affordable To Buy a Home

For the first time in quite a while, affordability is easing. That’s a meaningful shift.

And because this improvement isn’t happening everywhere at the same speed, understanding what’s changing locally is what really makes a difference. If you want to see how these trends show up in our area, let’s talk it through.

Home Insurance Costs Are Rising: What Buyers Should Plan For

If you’re thinking about buying a home, don’t forget to plan ahead for your homeowner’s insurance.

While costs are rising, knowing what to expect and how to shop around can make a big difference as you’re budgeting for your purchase. Because this isn’t coverage you’ll want to skimp on. It’s your best protection for what’s likely your biggest investment.

12,000 People Reach Retirement Age a Day

For a lot of homeowners, retirement changes how they think about home. Nearly 12,000 people will turn 65 every day for the next 2 years. And many are realizing they want life to feel simpler, with less upkeep and fewer expenses. That’s why they’re downsizing. And their home equity is what makes it possible. If retirement is on your radar, a simple conversation about your options can go a long way. No pressure. Just information to get you excited about what comes next.

Why So Many Homeowners Are Downsizing Right Now

Downsizing is about setting yourself up for what comes next – on your terms.

If retirement is on the horizon and you’ve started wondering what your current house (and your equity) could make possible, the first step isn’t selling. It’s understanding your options.

Let’s talk. A simple, no-pressure conversation can help you see what downsizing might look like – and whether it makes sense for you.

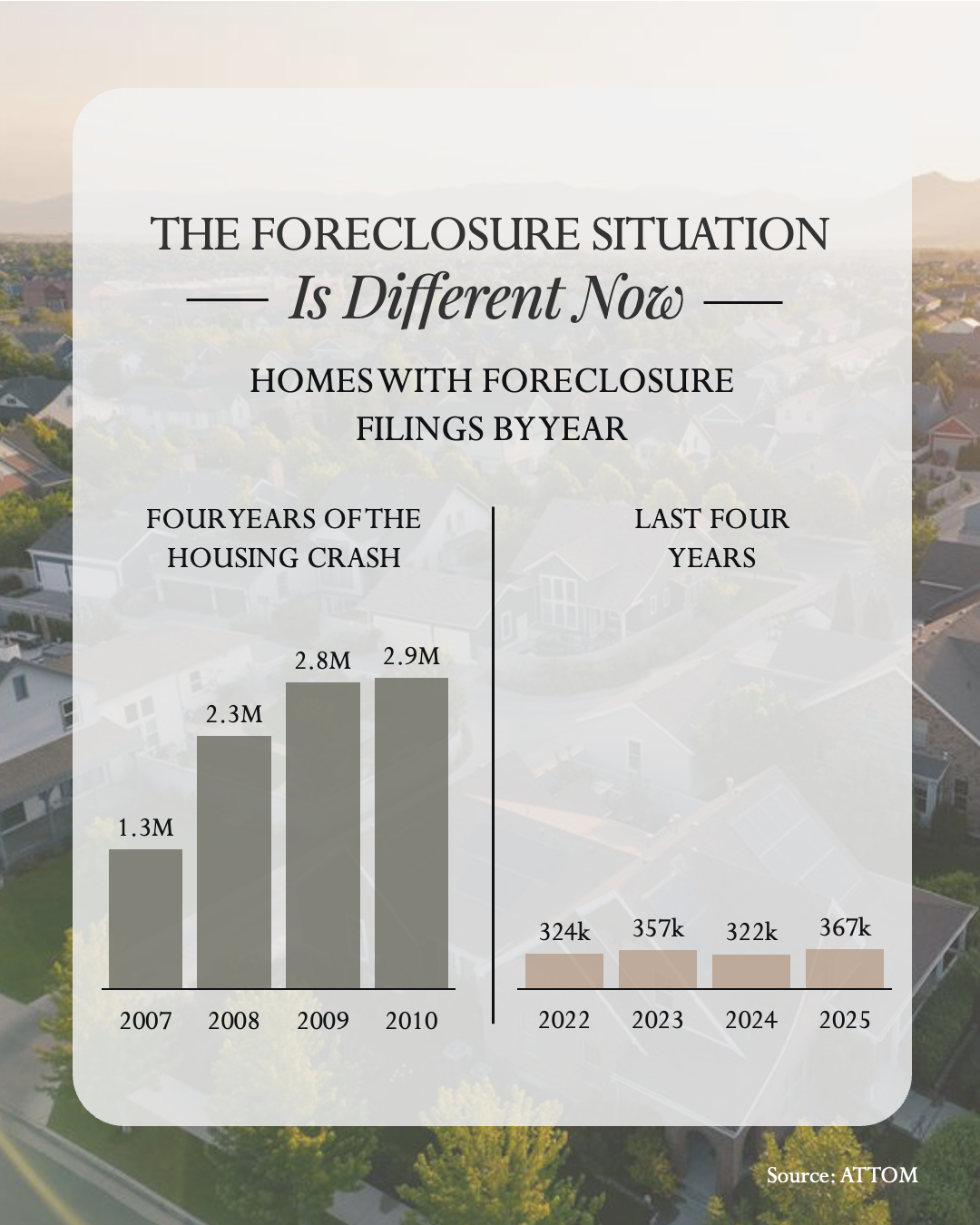

Foreclosure Filings Are Not Like 2008 Chart

Headlines about the double-digit jump in foreclosure filings sound scary – until you zoom out. This visual says everything.

Why Rising Foreclosure Headlines Aren’t a Red Flag for Today’s Housing Market

Foreclosure activity may be rising, but it’s still well within a normal range – and nowhere close to the danger zones of the past. But the headlines are doing more to terrify than clarify. And that’s exactly why having a trusted real estate expert you can call on is so important.

When you hear something in the news or see something on social about housing that worries you, please reach out so you have the context to understand what’s really happening and how it impacts you (if at all).

Mortgage Rates Recently Hit a 3-Year Low. Here’s Why That’s Still a Big Deal.

Mortgage rates dropping to a 3-year low isn’t just a headline.

For many buyers, where rates are now could be the difference between watching from the sidelines and finally getting the keys to their next home.

If you’ve been waiting for a sign to re-run your numbers and see what’s possible now, this is it.

Let’s take a look at what today’s rates mean for your budget and your options.

Home Updates That Actually Pay You Back When You Sell

If you’re looking to sell this spring, you still have time to make updates that help your home stand out – without taking on a full renovation.

If you’re not sure where to start, let’s talk through what makes sense for your house. A quick conversation can help you prioritize the updates that’ll pack the biggest punch.

What’s one upgrade you’ve been thinking about – and wondering if it’s worth it?

Are Big Investors Really Buying Up All the Homes? Here’s the Truth.

If you want to talk through what investor activity actually looks like in our local market, and how it impacts your options (or doesn’t), let’s connect.

Sometimes a little context makes all the difference.

The #1 Regret Sellers Have When They Don’t Use an Agent

Today, the biggest risk of selling without an agent isn’t the paperwork or the hassle. It’s the price. And once pricing goes wrong, it’s hard to course correct.

So, if you’re thinking about selling and want to understand what your home would realistically go for in our market today, let's connect. A quick pricing conversation now can save you from bigger regrets later.

The Credit Score Myth That’s Holding Would-Be Buyers Back

Your credit score is important. But that doesn’t mean it has to be perfect.

If credit has been the reason you’ve been waiting to buy a home, it might be time to take another look at your options. If you want help understanding where you stand and what your next step could be, connect with a local lender.

You don’t need to have everything figured out to start the conversation.

Expert Forecasts Point to Affordability Improving in 2026

Affordability won't change suddenly overnight. But, with several key trends working together, it should slowly and steadily improve in the months ahead.

That’s exactly why, in 2026, you should see a market with more balance, more predictability, and more breathing room than you’ve had in years.

Want more information about the opportunities unlocking in our local market?

Let’s chat.

Thinking about Selling Your House As-Is? Read This First.

While selling as-is can still make sense in certain situations, in some markets today, it may cost you. So, no, you don’t have to make repairs before you list. But you may want to.

To make sure you’re considering all your options and making the best choice possible, let's have a quick conversation about your house.

Why Pre-Approval Should Be Your First Step, Not an Afterthought

Pre-approval doesn’t restrict you—it opens doors.

In today’s market, the buyers who succeed aren’t the ones who wait—they’re the ones who plan ahead. If you’re considering buying in the coming months, get a head start by connecting with your agent and a trusted lender. They’ll guide you through the process, ensuring you’re fully prepared to act the moment the right home appears.

Reasons To Be Optimistic About the 2026 Housing Market

If you want to talk through what’s expected for our local market and which trends you’ll want to take advantage of, let’s connect.

Turning a House Into a Home: The Benefits You Can Actually Feel

Buying a home isn’t only about dollars and data points – it’s about building a life you love.

So, if you’re thinking about a move in 2026, keep the emotional side in the conversation too. And when you’re ready to explore your options, let's connect so you have a pro on your side to guide you through the process with clarity and confidence.

Headlines Have You Worried about Your Home’s Value? Read This.

If you’re hearing talk about price drops or crashes, a closer look at the data can help put things in perspective. That’s only happening in some markets. Most of the nation is still seeing prices rise.

And for the vast majority of homeowners, the long-term gains far outweigh any recent softening.

If you want help understanding what’s happening in our local market, let’s connect.

Is January the Best Time To Buy a Home?

If you’ve been thinking about taking the next step, this season might give you more opportunity than you think.

Curious what buying in January could look like for you? Let’s take a closer look at your numbers and the homes that are available in our area.

Is Buyer Demand Picking Back Up? What Sellers Should Know.

Want to know what's happening with buyer activity in our area, and what it could mean if you want to sell your house in the new year?

Let’s talk about getting your house listed in early 2026, so you can take advantage of this momentum building in the market.